Tax season is coming quickly which means wrapping up bookkeeping and get those last-minute questions answered. You work hard to increase rental profits and your accountant can help you find ways to maximize your ROI through tax savings. Rental real estate offers favorable tax advantages compared to other types of investments.

One of the biggest benefits of owning rental property at tax time are the special opportunities to deduct expenses related to your rental property and rental income. Furthermore, when you rent a property to others as a landlord or real estate investor, you must report the collected rental income as taxable income.

The law allows businesses to participate in tax saving efforts and a Certified Public Accountant who understands the property management and rental industry will usually have the inside scoop.

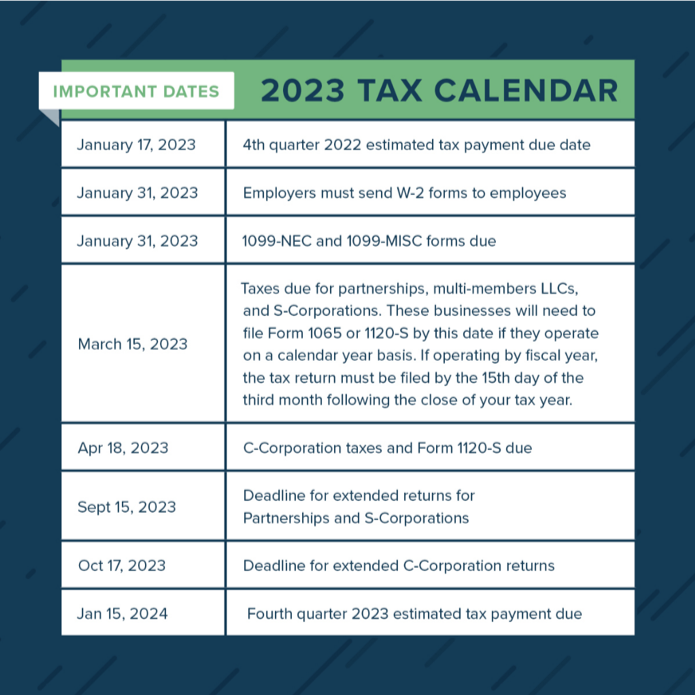

OWNERS: Watch the mail for your 2022 Form 1099-MISC. This form shows the amount of rent collected on your behalf in 2022 and is reported to the Internal Revenue Service. Please consult your CPA or tax adviser on how to properly report this income on your 2022 tax return. Your CPA or tax adviser can also help you deduct all the expenses available to rental property owners.

Get ready for the upcoming tax season with these property management bookkeeping reminders and important questions to ask your accountant like:

What information do you need from me?

Ask how to prepare, document, and organize financial reports from an accountants’ perspective. Understand the reports and information they need from you and the format they would like that presented.

What business expenses can I deduct?

If you work from home, ask about deductions for office space and utilities. Landlords spend much time traveling for inspections, showings, post office, supply runs, banking, etc. Remember to ask about travel deductions and how to keep those records.

What should I do now to save on taxes for next year?

It’s never too early to start planning, especially when it comes to saving money.

How do I report rental income and expenses?

According to the IRS, landlords normally report rental income on Form 1040, Schedule E, Part I. List your total income, expenses, and depreciation for each rental property on the appropriate line of Schedule E.

For investment properties, the following is a list of some of the documents needed to prepare your tax returns:

- Documentation on the revenue you received.

- Form 1098 to document interest paid

- Your real estate tax bill per calendar year

- Your homeowner’s insurance premium paid

- Repairs & Renovation costs

- Management fees

- Legal, Professional services, and Realtor fees

Finally, make sure to speak with your tax preparer on what supporting documentation is needed to verify income and the expenses paid.

These are just some of the questions you should be asking your accountant about as a landlord. If you have questions about the properties that we manage, feel free to reach out so we can help you maximize your investment.